Medicare Part D

Find Affordable Medicare Plans

What is Medicare Part D?

Summary:

Medicare Part D is prescription drug coverage. You can get Medicare Part D coverage through a stand-alone Medicare Prescription drug plan or a Medicare Advantage prescription drug plan. Both are available from Medicare-approved private insurance companies.

Medicare part D coverage is optional, but if you don't enroll in Medicare Part D as soon as you're eligible, you might pay a late-enrollment penalty if you enroll later.

Your monthly plan premium and out-of-pocket expenses for prescription drugs will vary from plan to plan.

It can be a good idea to review your Medicare Prescription Drug Plan coverage every year to see if your plan covers the medications you need now and may need in the upcoming year.

Every Medicare prescription drug plan has a formulary - That is, a list of covered drugs. The formularies vary among plans.

Be aware that your plan may change its formulary. You may want to review the Annual Notice of Change that the plan sends you every fall to make sure it will still cover your prescription medications in the coming year.

What else should you know about Medicare Part D prescription drug plans?

No matter what type of Medicare prescription drug plan you have, here are some things to keep in mind.

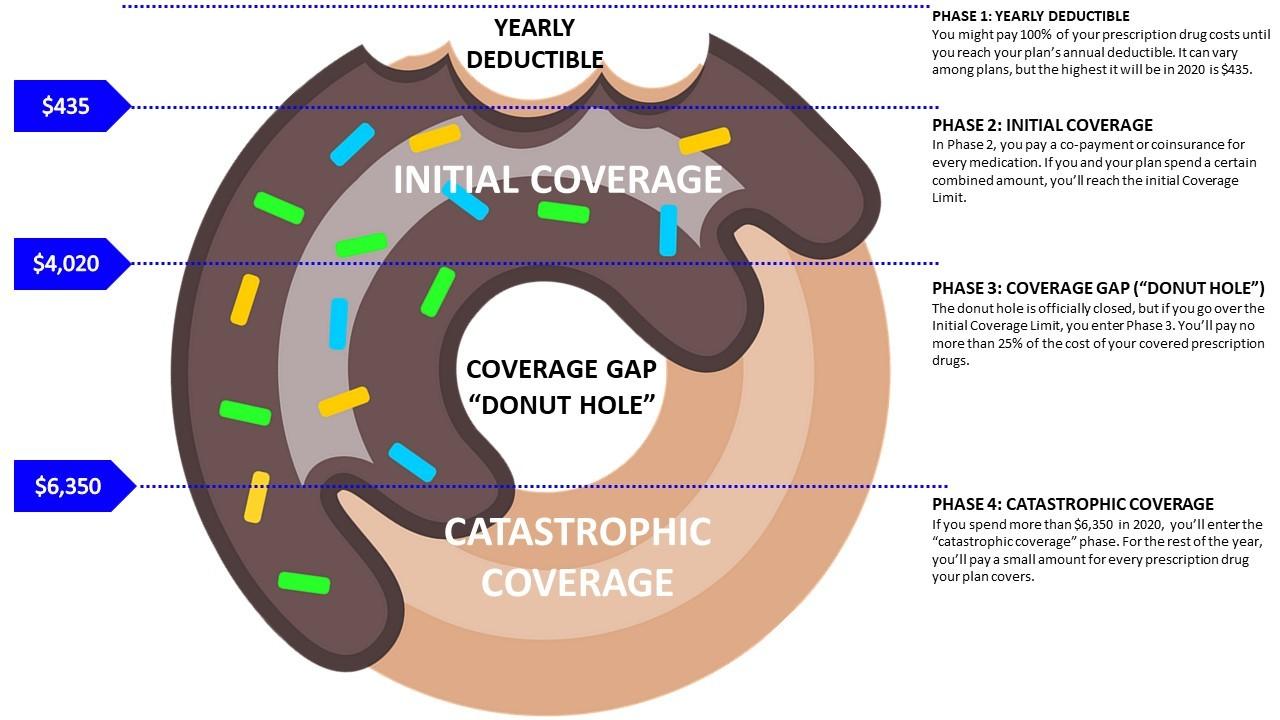

- If the plan has an annual deductible, you generally pay the full amount of your prescription drug purchases until the deductible is met.

- After you satisfy the annual deductible, you will pay a share of the costs according to the terms of your plan. Your share, which you typically pay to the pharmacy at the time of pickup, could be a flat amount (co-payment) or a percentage of the total amount (coinsurance).

- If you and your plan spend a combined $4,020 in 2020 (an amount called the initial coverage limit), you'll enter a different Medicare Part D coverage phase. During this phase, you'll pay no more than 25% of the cost for each covered prescription. The initial coverage limit may change from year to year.

- Once you have paid a certain annual maximum amount out of your own pocket for covered prescription drugs, you automatically get "catastrophic coverage." This means for the rest of that particular year, you would only pay a small co-payment or coinsurance amount for prescription drugs. Medicare Part D catastrophic coverage begins when you've spent $6,350 in 2020. This amount may change from year to year.

Be sure to talk to your doctor to see if you are taking the lowest cost medications available to you. Specific coverage may vary from plan to plan, so read your documentation carefully.

MEDICARE PART D COVERAGE PHASES

Your out-of-pocket costs in Medicare Part D Prescription drug plans depend on which of the four coverage phases you're in.

Note that all of these phases are "per year." The dollar amounts for each phase may change from year to year.

Who's eligible for a Medicare Part D prescription drug plan?

Any beneficiary who is eligible for Original Medicare, Part A and/or Part B can sign-up for a stand-alone Medicare Part D prescription drug plan, you need to have both Part A and Part B.

In either case, you must live within the plan's service area.

You can sign up for either type of Medicare prescription drug plan only during certain enrollment periods.